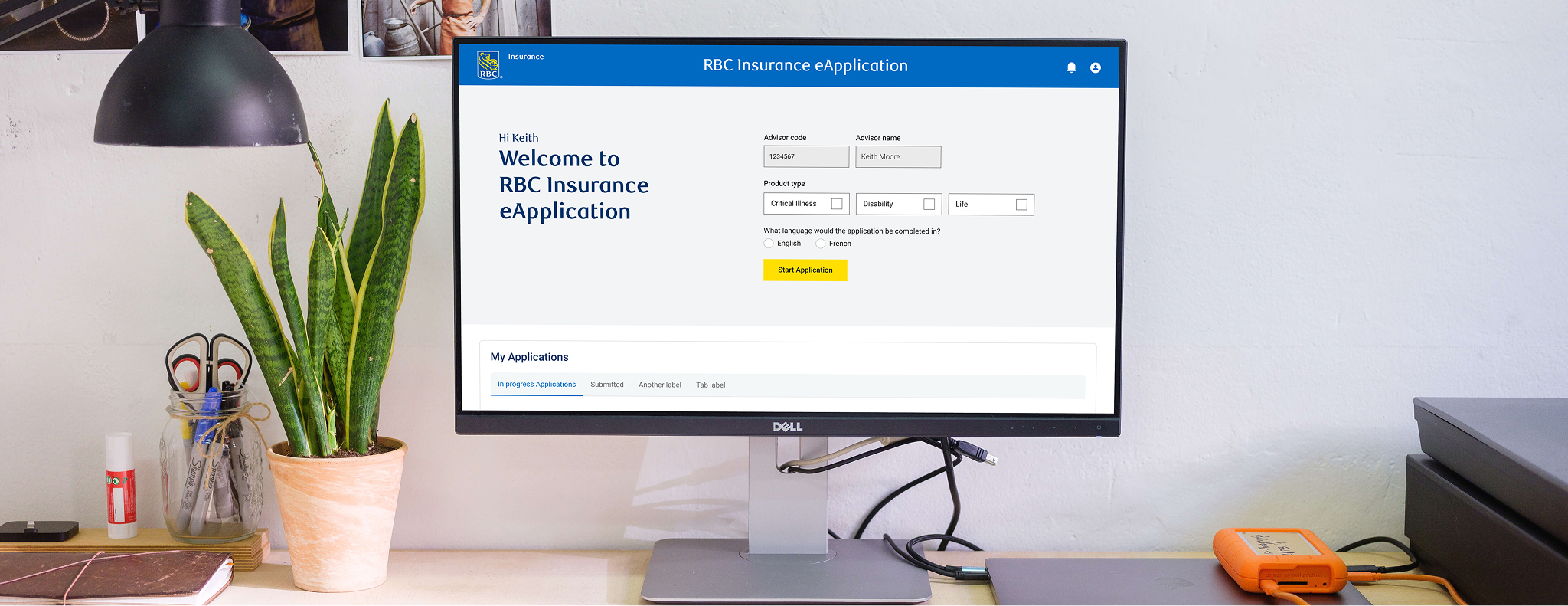

Reducing Insurance Application Time by 50% Through Platform Consolidation

Led product strategy and cross-functional development of a unified Salesforce platform consolidating Critical Illness, Life, and Disability insurance products. Defined requirements for a dynamic rules engine and modular architecture that eliminated data silos, reduced processing time by 50% (2 hours to 1 hour), and drove a 25% growth in applications from brokerage advisors.